Market cycles are a fundamental concept in economics and finance, influencing decisions for investors, businesses, and policymakers alike. These cycles represent the natural rise and fall of economic and market conditions, and understanding them can provide key insights into when to buy, sell, or hold assets.

In this article, well explore what market cycles are, how they work, and the different types that investors should be aware of. By grasping these concepts, youll gain a clearer picture of how financial markets behave over time and how to navigate them strategically.

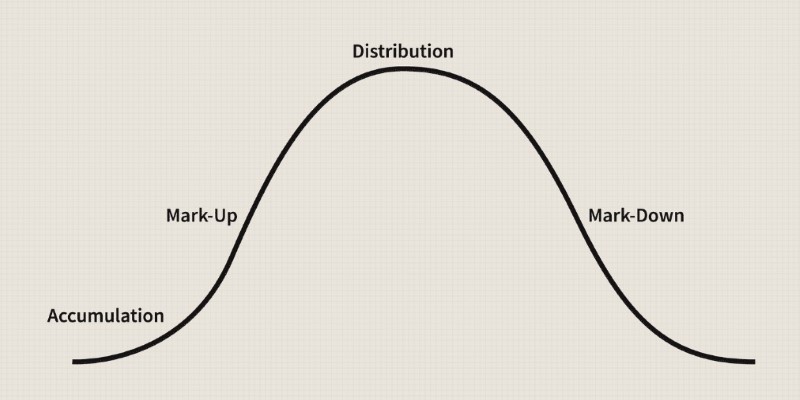

Market cycles refer to the recurring phases of growth and contraction within an economy or a financial market. These cycles are characterized by periods of expansion, peaks, contraction, and troughs, typically reflecting broader economic trends. Although market cycles are most often associated with stock markets, they affect all types of financial assets, including real estate, bonds, and commodities.

The cyclic nature of markets isnt newit has been observed for centuries. The idea is rooted in human psychology, investor behavior, and macroeconomic factors that collectively drive prices up and down. Understanding these patterns allows investors to make more informed decisions based on where the market currently stands within the cycle.

Market cycles can be categorized based on their duration, underlying cause, and the type of assets they affect. Here are some of the most commonly recognized types:

Also known as business cycles, economic cycles refer to the broader economic fluctuations that occur over time. They are driven by factors like GDP growth, employment levels, and inflation rates. They typically last several years and include the stages of expansion, peak, contraction, and trough. Economic cycles have a profound impact on stock markets and other financial sectors.

These are long-term cycles that can span multiple decades. Secular cycles are generally divided into secular bull markets (prolonged periods of market growth) and secular bear markets (extended periods of market decline). Understanding secular trends is crucial for long-term investors as they dictate the overall direction of markets over extended periods.

These cycles specifically pertain to fluctuations in stock prices. They are often shorter than economic cycles and can be influenced by a wide range of factors, including earnings reports, interest rate changes, and investor sentiment. Stock market cycles include periods of bullish (rising) and bearish (falling) market conditions.

Different sectors of the economy, such as technology, healthcare, or energy, can experience their cycles independent of the broader market. For instance, the technology sector might boom during periods of innovation and growth, while other sectors may lag. Investors often shift their focus between sectors depending on which phase of the economic cycle the market is in.

The real estate market also follows a cyclical pattern, with periods of rapid price increases followed by corrections or downturns. These cycles are driven by factors such as interest rates, lending standards, and demographic trends. Real estate cycles can be particularly important for investors involved in property development, rental markets, or REITs (Real Estate Investment Trusts).

A combination of factors, including economic indicators, interest rates, inflation, corporate profits, and investor sentiment, influences market cycles. Each cycle typically follows four main stages: expansion, peak, contraction, and trough. These phases are interconnected and follow a consistent order, although their duration and intensity can vary.

This is the growth phase, where the economy is doing well, and financial markets are generally rising. Businesses see increasing profits, unemployment is low, and consumer confidence is high. During this period, investments often yield positive returns, leading more investors to participate in the market.

The expansion phase eventually hits its limit, leading to a peak. At this point, asset prices are at their highest, and the economy may be showing signs of overheating, such as high inflation or speculative bubbles. Investor optimism is often at its peak, which can create unsustainable market conditions.

After reaching the peak, the market begins to decline. This phase is marked by slowing economic growth, declining corporate earnings, and a drop in asset prices. The contraction phase often leads to bear markets, where widespread pessimism can drive prices lower.

The cycle eventually bottoms out, reaching the trough. This stage is typically characterized by low investor confidence, economic stagnation, and reduced market activity. However, it also signals the end of the downturn and the beginning of the next expansion phase.

These phases may not always unfold straightforwardly, as they can be influenced by various external factors such as global events, government policies, and technological changes.

While market cycles tend to follow a consistent pattern, they are also influenced by a variety of factors, including:

Monetary Policy: Central banks play a key role in market cycles through their control over interest rates and money supply. For example, lowering interest rates can spur economic growth and extend the expansion phase, while rate hikes can trigger contractions.

Fiscal Policy: Government spending and taxation policies also impact market cycles. Increased public spending or tax cuts can stimulate economic activity, while austerity measures can slow growth.

Investor Sentiment: Market cycles are heavily influenced by collective investor behavior. During periods of optimism, prices can rise above fundamental values, creating bubbles. Conversely, panic selling during downturns can exacerbate market declines.

Global Events: Wars, pandemics, and geopolitical shifts can disrupt market cycles, either shortening or lengthening different phases depending on their impact on economic activity.

Market cycles are a natural part of how economies and financial markets function. By understanding the different phases of a cycle and recognizing the types of cycles that exist, investors can make more informed decisions and better manage risk.

Although predicting the exact timing of market shifts is nearly impossible, being aware of where the market stands within a cycle offers valuable context. Whether youre a long-term investor or an active trader, knowledge of market cycles is a critical component of successful investment strategies.

By Aldrich Acheson/Aug 25, 2024

By Celia Shatzman/Sep 20, 2024

By Paula Miller/Sep 23, 2024

By Nancy Miller/Sep 18, 2024

By Alison Perry/Sep 18, 2024

By Korin Kashtan/Sep 18, 2024

By Christin Shatzman/Sep 23, 2024

By Gabrielle Bennett /Sep 23, 2024

By Kelly Walker/Jul 13, 2024

By Elva Flynn/Sep 06, 2024

By Susan Kelly/Sep 05, 2024

By Susan Kelly/Aug 25, 2024