Throughout history, stock market crashes have been pivotal moments that reshape economies and cause significant financial and social upheaval. These dramatic events often stem from a combination of speculation, fear, and unexpected market shifts. A comprehensive look at these crashes, starting with the infamous 1929 Wall Street Crash, can offer insight into how such collapses occur and their long-lasting impact on economies and investors. The 1929 crash is one of the most notable, but it's important to recognize the many other market downturns that have shaped modern financial systems.

The stock market crash of 1929, commonly referred to as the Great Crash, stands as one of the most significant financial disasters in history. Leading up to the crash, the U.S. economy had been booming throughout the Roaring Twenties, driven by massive speculation in stocks. Many investors borrowed heavily to buy stocks, anticipating that prices would continue to rise. However, the bubble burst in October 1929, starting on Black Thursday (October 24), when the market dropped by 11% at the opening bell. Efforts by major banks to halt the panic proved unsuccessful.

The real catastrophe occurred on October 29, 1929, now known as Black Tuesday. On that day, investors traded over 16 million shares, and the market lost an additional 12%. By the end of the crash, the Dow Jones Industrial Average had plummeted by nearly 25%, erasing billions in wealth overnight.

While stock prices showed some recovery in the weeks following the crash, the damage was irreversible. Banks began to fail, businesses shut down, and unemployment soared. By 1932, stocks had lost almost 90% of their value from the 1929 peak. This catastrophic collapse played a direct role in triggering the Great Depression, a worldwide economic slump that persisted for more than ten years.

While the 1929 crash is perhaps the most well-known, other stock market collapses have also left their mark on history. Here are a few of the most notable:

On October 19, 1987, the Dow Jones Industrial Average saw its largest single-day percentage loss in historyover 22%. Dubbed Black Monday, this crash was triggered by a combination of computerized trading, market psychology, and financial uncertainty. Unlike the 1929 crash, the economy was more resilient, and markets recovered relatively quickly. However, the event raised serious concerns about the volatility of the stock market and the reliability of trading systems.

The late 1990s witnessed a surge in tech stocks as investors rushed to capitalize on internet-based companies. Unfortunately, this speculative frenzy created a massive bubble, which burst in early 2001. The collapse of the dotcom sector led to significant losses for investors and contributed to a recession in the early 2000s. Many internet startups went bankrupt, erasing billions of dollars in market value.

Perhaps the most significant market crash since 1929, the 2008 crisis was rooted in the U.S. housing market. Excessive lending, risky financial products, and inadequate regulation caused the downfall of major financial institutions like Lehman Brothers. This sparked a global recession, with markets losing trillions of dollars in value. Governments and central banks worldwide had to intervene with massive bailouts and stimulus packages to stabilize the financial system.

The effects of a stock market crash extend far beyond immediate financial losses. A significant crash can undermine consumer and business confidence, leading to reduced spending and investment. This decrease in economic activity often results in layoffs, a slowdown in business growth, and, in some instances, bank failures. A prime example is the 1929 crash, which plunged the U.S. into the Great Depression. By 1933, nearly 50% of American banks had failed, and unemployment soared to 25%.

The ripple effects of stock market crashes can last for years, depending on the severity and the measures taken by governments and financial institutions. For example, following the 1987 Black Monday crash, global markets managed to recover within two years. However, the 2008 financial crisis proved more challenging. Although stock markets started to stabilize in 2009, the broader economy took much longer to recover. Housing markets collapsed, unemployment spiked, and the effects lingered for years, with a full recovery taking over five years in some sectors.

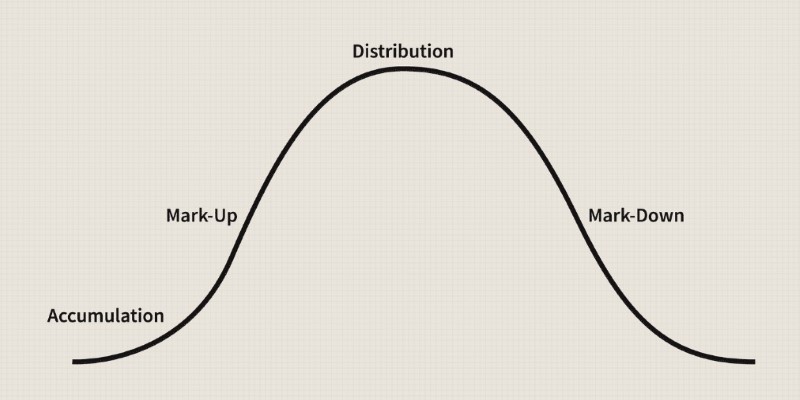

Stock market crashes are complex phenomena that typically arise from a combination of speculative bubbles, investor panic, and external shocks. Speculative bubbles form when asset prices, driven by excessive optimism and irrational behavior, rise far beyond their intrinsic value. This creates an unsustainable market, which can burst when investors begin to realize the overvaluation. Panic selling often follows as investors rush to offload stocks, amplifying the market decline.

Several external factors can trigger or exacerbate crashes. Geopolitical events, such as wars or political instability, can create uncertainty, prompting investors to withdraw funds. Natural disasters or global pandemics can also disrupt markets by slowing down economies. Economic mismanagement, such as poor regulation or risky financial practices, adds further instability.

In 1929, rampant speculation, combined with minimal oversight, laid the groundwork for the Great Crash. A lack of income distribution also meant that many were heavily leveraged, worsening the crisis. In 1987, computerized trading systems contributed to rapid market declines as automated sell orders flooded the market. The 2008 crash was largely driven by the housing bubble and risky mortgage-backed securities, which had been poorly regulated.

Conclusion

Stock market crashes have shaped the global economy in profound ways. From the devastation of the 1929 crash and the Great Depression to more recent downturns like the 2008 financial crisis, these events serve as stark reminders of the volatility of financial markets. While modern economies are better equipped to handle market fluctuations, the possibility of future crashes remains. Investors, regulators, and governments must stay vigilant, learning from past mistakes to mitigate the damage of future financial crises.

By Gabrielle Bennett /Sep 23, 2024

By Korin Kashtan/Sep 18, 2024

By Kelly Walker/Jul 13, 2024

By Martina Wlison/Sep 22, 2024

By Kristina Cappetta/Sep 19, 2024

By Isabella Moss/Sep 19, 2024

By Juliana Daniel/Sep 23, 2024

By Sid Leonard/Sep 06, 2024

By Elva Flynn/Sep 22, 2024

By Elena Davis/Sep 23, 2024

By Maurice Oliver/Sep 18, 2024

By Susan Kelly/Sep 05, 2024